What You Can Do In 1 Month To Save Money & Transform Your Finances: WEEK 1

Life is busy and tackling your finances may not always be at the top of your to do list. Unfortunately, money is a part of our everyday lives. While some people worry about their finances, others try not to even think about it. But taking a hold of your finances and having a good financial base will make your life run a little bit smoother. It might even make looking at your financial situation a little less scary.

There are a lot of different ways to tackle your money woes. It can be as simple as saving a few bucks by not buying that Venti Iced Caramel Macchiato or as complicated as investing your money and watching it ride the stock market roller coaster. Either way, you are taking the time to think about your finances and that is what is really important.

We have put together a list of ways that you can transform your finances and have decided to split up this month long challenge into 4 different weeks. Pick one or do them all, either way you will be taking a step in the right direction.

We personally do or have done all of these steps and it has made us more financially aware. These tips have gotten us completely out of debt, have helped us pay off our mortgage in just two years, and have allowed us to significantly increase our net worth.

*This site contains affiliate links to products or services. We may receive a commission for purchases made through these links.

WEEK 1:

1. Lower Your Bills With A Phone Call

Most of the time all it takes is a simple phone call to lower your monthly bills. Whether it be for your internet, cell phone, cable, car insurance, or homeowners insurance there is usually a good chance of getting your payment decreased just by calling and asking. You may be eligible for a loyalty or retention discount and not even know it. Just ask. The worst they can say is no. And if they say no, you may want to do a little bit of research and see if you can find a lower rate with another company.

2. CABLE – Is It Time To Cut The Cord?

We have been without cable for 5 years now and can’t imagine ever getting it again. Sure there are some shows that we miss but we always say that we would be so much less productive if we had cable. Besides the massive amount of time that we would waste watching TV, an even bigger reason to not have it is COST. If you spend $100/month on cable that equals $1200/year and $6000 over 5 years. No Thanks!

If you are not yet ready to completely cut the cord there are many other streaming devices out there that would still allow you the guilty pleasure of sitting on your couch and zoning out for an hour or two minus the high cost. Some other options include: Netflix, Hulu, Sling TV, Amazon Prime Video, YouTube, YouTube TV, Roku, ESPN+, Disney+, Philo, and fubo TV.

Another great option is to get a Digital Antenna. There is only the initial cost of getting the antenna with no monthly cost. Also, unless you live in the middle of nowhere, the chances of getting all of the local channels and then some is very high, depending on your location.

And if you want to go really cheap, there’s always the good ol’ library where they usually have a big selection of DVDs and IT’S FREE.

For a FREE 3 day trial of Amazon Prime, including video, click here.

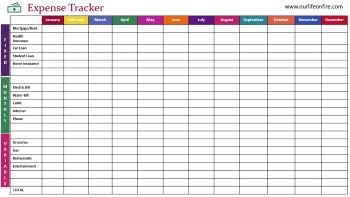

3. Track Your Expenses

Have you ever tracked all of your expenses? We started tracking our major expenses (utilities, homeowners insurance, car insurance, etc) last year and just this year also added in everyday expenses (restaurants, gas, groceries, etc). It’s actually eye opening to see where our money goes and how much we spend on certain items and activities. This information forces us to take responsibility for our spending and makes us want to look for ways to cut costs.

Download your FREE Expense Tracker Below:

4. Open A High Yield Savings Account

If you put $10,000 in a standard savings account for 1 year, you will earn $1 in interest. That is because most standard savings accounts have an interest rate of 0.01%. But if you put that $10,000 in a high yield savings account for 1 year, with an interest rate between 1-1.5% you could earn $150 in interest. Sounds like a no-brainer to me.

The Pro to using a high yield savings account is making more money. The Con is that there are some restrictions to using these accounts. Most of these accounts only allow you to have a set number of withdrawals, usually 6, per calendar month. So if you need to withdraw money more often than this you will definitely need to have a second account to use in order to have your money accessible to you.

Related Articles:

What You Can Do In One Month To Save Money And Transform Your Finances: Week 2, Week 3, Week 4

How To Successfully Create A Budget Today (FREE Budget Tracker Included!)

5. Talk About Your Finances With Your Significant Other Or Friend

Talk about your finances to someone else? How Taboo! Your finances may not be the most comfortable dinner topic but conversation leads to new ideas, motivation, encouragement, and change.

6. Increase Your Retirement Contribution To Your 401k

If you are not already contributing to your company’s 401k, you should be, especially if they offer a match. If you are already contributing and have it in your budget to increase your contribution amount, then you should.

The money that you contribute to your 401k does not count towards your gross earnings which lowers your taxable income. Also, the money that you contribute grows tax-deferred. Your earnings do not have to be reported as income during your yearly tax returns, you only pay taxes when you withdraw the funds. This allows your money to grow faster due to compound interest.

Our strategy: Put 100% of our earnings towards our 401k until it is maxed out. If you are able to do this, we highly recommend it. It allows you to get more money invested at the beginning of the year, giving it more time to grow. The max contribution to a traditional 401k for 2020 is $19,500.

7. Set Financial Goals

Goal Setting is a powerful resource that will bring focus to your life. When you set financial goals you are essentially writing out the steps that you need to follow in order to succeed. It gives you a clear path to follow and something to strive for.

This 1 Month Challenge to Save Money and Transform Your Finances is a great way to start making some changes in your life and establish good financial habits.

We will be posting a new week of suggestions, tips, tricks and recommendations every Monday until the end of the month. Stay tuned!