How To Get Out Of Debt Fast

There are a lot of people in this world who are looking to get out of debt fast. Unfortunately, the statistics tell a sad story of how people in the U.S. are inundated in debt.

Having debt hanging over your head can be overwhelming. The thought of having to dig yourself out of a big debt hole is daunting to say the least. Debt can be the cause of unnecessary worry and stress in our lives.

Statistics According to the Federal Reserve Bank of New York

- American household debt balances total $14.3 trillion

- Outstanding student loan debt is at $1.54 trillion

- Auto loan balances are at $1.35 trillion

Other statistics:

- 1 out of 10 adults in the U.S. carries a credit card balance over $5000

- The average credit card APR is 17.73%

Common types of debt:

Most people have some type of debt. Personal debt can be categorized into four different categories.

Secured Debt:

A Secured Debt is backed by collateral. Should you default on your payment the creditor can take the collateral. The interest rates on this type of loan are usually lower due to the fact that the lender can seize the property and recoup their money if you default on the loan. Examples of a secured debt is a property loan/mortgage and car loan.

Unsecured Debt:

This type of debt tends to have higher interest rates because there is no collateral to collect upon default of the loan. An example of unsecured debt is a credit card or personal loan.

Mortgage:

A mortgage is a loan given to a person to purchase a home. A mortgage typically has the lowest interest rate and is usually set for terms of 15 or 30 years. In this case, the property is the collateral.

Revolving Debt:

This type of debt involves an agreement between lender and lendee. It allows the consumer to borrow money up to a maximum amount. An example of revolving debt is a credit card.

Is all debt bad?

Actually, no. Not all debt is considered bad.

Bad Debt is when you purchase something that is not income producing.

Good Debt is when you purchase something that has the potential to increase your net worth.

An example of bad debt is credit card debt. An example of “good debt” is a mortgage.

One thing to take into consideration when looking at good debt vs. bad debt is the emotional response to debt. In either case, the emotional response doesn’t really change. There is still that feeling of worry or stress even if you take on “good debt.”

What are the first steps to pay off your debt?

So you have debt. The next question is…..how do you pay off debt? Even better, how do you get out of debt fast!?

1. Review your finances:

First you must organize your finances and find out where you stand. The easiest way to do this is to list your debts, interest rates, and minimum payments. You can also use a debt calculator. They are great because it gives you a lot of additional information such as how much interest you will be paying and how long it is going to take you to pay off your debt .

2. Set goals:

You need to have a plan to tackle your debt. When you set goals, you need to remember to include an action plan and time frame.

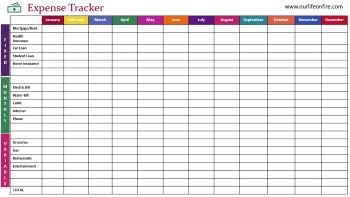

3. Track your expenses:

It is imperative that you know where your money is going. The only way that you will know exactly what you are spending money on is by tracking your expenses.

This step is a twofer. First it will help you to get your finances organized. Second it will open up your eyes to any frivolous spending. It will allow you to see if there are places that you can cut costs and live a little more frugally.

4. Create a Budget:

Creating a budget is not as hard and overwhelming as many people think. The key is to choose a budgeting strategy that works for your lifestyle. When you make a budget you are keeping track of your income and expenses. The money that is left over can go towards many things, one of which should be to pay down your debt.

How to pay down your debt AND get out of debt faster:

So now you’ve completed the initial steps. The dirty work is out of the way. Time to tackle your debt with “gazelle intensity!” Thank you Dave Ramsey for getting that phrase permanently stuck in my head.

The next steps are:

1. Pay more than the minimum balance…..always and as often as you can!

By lowering the overall total debt that you have you will automatically pay less interest in the long run. Debt is bad. Paying interest is worse.

2. Live below your means/frugal living:

The definition of living below your means is to not spend more money than you make. This step is crucial if you want to get out of debt fast. I’m not saying that you need to live an extremely frugal lifestyle. But you need to be intentional with your spending.

3. Use extra (found) money to pay off debt:

If you happen to come across some extra money from a bonus at work or a monetary gift, use it to pay off your debt. You should focus on lowering that overall total.

4. Start a side hustle or get a part time job:

If you feel that you are really trying to live more frugally but there is just nowhere else to save money then it’s time to find a way to make more money.

You can make more money by starting a side hustle or picking up some extra work at your normal job. A part time job may also be an option for you to make some extra cash on the weekends or at night.

5. Call your credit card company:

Request a decreased interest rate on credit cards. If you are unable to pay your balance in full every month you can save yourself a lot of money by just decreasing your interest rate. Make the call…..the worst that they can say is “no.” Another option is to move your balance to a card with an introductory 0% rate.

Debt Payoff Strategies:

Both of these debt repayment strategies call for paying off the minimum balance first on all debt then choosing one of these methods. You do not neglect to make a payment on one debt just to tackle another.

Debt Avalanche:

In this method you pay off the biggest debt first – the one that charges the most interest.

Debt Snowball:

In this method you pay off the smallest total debt first

Why would you choose one over the other?

In the Debt Avalanche strategy you are working towards getting rid of the debt with the highest interest rate. Depending on the size of your debt, this can save you hundreds and take months off of your repayment time.

If you choose the Debt Snowball strategy, you will have one debt completely wiped out quickly. This is a great motivator to keep going. Getting rid of one of our debts allows us to clearly see progress.

Related Articles:

Frugal Living Tips That Make A Big Impact

What You Can Do In One Month To Save Money And Transform Your Finances

How To Successfully Create A Budget Today

Final thoughts

Getting out of debt is not easy. There is no “get out of debt free” card. It takes work and dedication.

Being in debt can be overwhelming and stressful. It may seem like it is impossible to get out of debt on a low income or if you have several different types of debt. But if you are in this position and need a way out, there are simple strategies that you can use to start to get out of debt today.

The key ways to get out of debt fast is to save money, make more money and choose a payoff strategy that works for you. You need to pick a method that you can and will stick to in order to be successful.

All of these strategies on how to get out of debt fast are useful and will help you to obtain financial freedom. Reaching financial freedom and being debt free will allow you to live the life that you want instead of being chained to financial obligations.

7 thoughts on “How To Get Out Of Debt Fast”

wow! some great tips here!

thank you for sharing!

Totally agree with paying off debt. We have aggressively been paying down our student loans. I cannot wait until I don’t have to care if I have a job.

Getting out of debt is definitely a good feeling! Sounds like you are on the right path – best of luck to you!

Very informative! I tried the avalanche method once and it didn’t work too well. As soon as the hard times hit, the debt came back. I’ll try the snowball method this time. Thank you!

I think the debt snowball method is great because it gives you a boost of confidence, mentally, when you see one of your debts completely disappear. Just take it one day at a time and be consistent – You will get there!

This is inspiring! Great advice on practical steps I can take right now to reduce my debt. Thank you!

Thanks! – Happy that we could give you some new tips on getting rid of your debt.